This report has been prepared by the economic observatory EIXOS, commissioned by API.cat, with the purpose of providing a clear overview of the retail real estate market in the major Spanish cities.

There are 12 Spanish cities with more than 300,000 inhabitants: Madrid, Barcelona, Valencia, Zaragoza, Málaga, Alicante, Murcia, Seville, Bilbao, Palma, Las Palmas, and Córdoba. Together, they have a total population of 10 million inhabitants, approximately 20% of the Spanish population, and a park of more than 250,000 retail spaces, about 25% of the total Spanish park.

Source: Eixos.cat.

Field staff from the network of geographic collaborators of the observatory Eixos.cat has visited each and every one of the more than 250,000 retail spaces, before, during, and after the pandemic, in order to provide the necessary data to make this report.

Retail Asset Valuation System. Location, Location, Location.

Based on the geographical location of each retail space, the conditions of the surrounding commercial environment within a radius of 250 meters have been established. For each retail space, the number and degree of retail occupation of the surrounding area have been determined, as well as the composition and commercial specialization of activities within the analysis radius.

Thus, a retail space located in an environment with more than 40 open retail spaces, an occupation rate of retail spaces above 80%, and a presence of convenience stores above 30%, has been rated with an A, a distinction for top-quality locations. Conversely, a retail space in an environment with more than 40 retail spaces and severe retail desertification (occupation <70%) has been classified with a D. This classification process has been applied successively to each and every one of the 250,000 retail spaces.

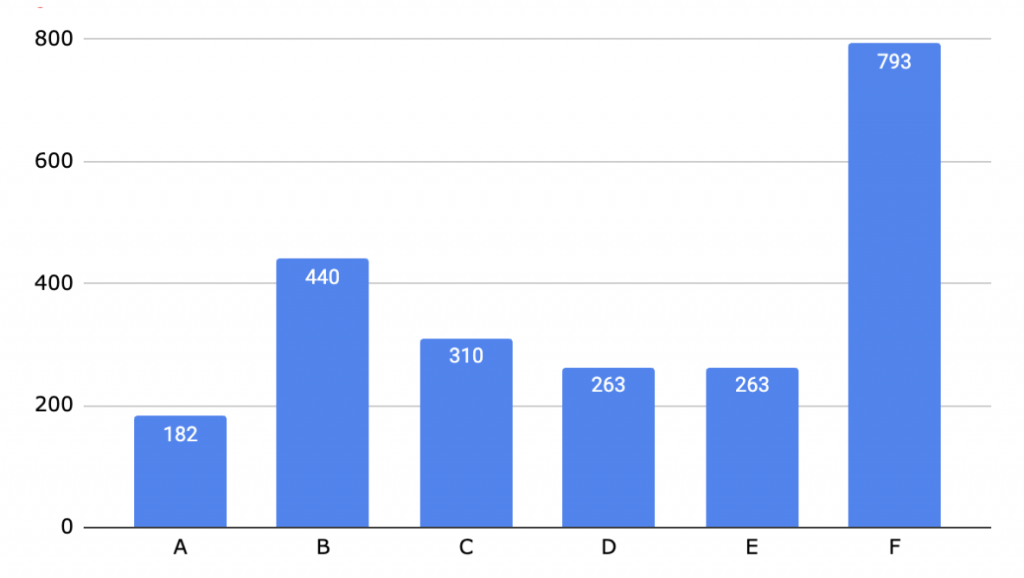

Hexagons Rating in >300 inh Cities

Scatter plot of hexagons based on retail occupancy (Retail Occupancy Index – ROI) and destination retail presence (Destination Retail Index – DRI).

Retail Asset Valuation System. Location, Location, Location.

Based on the geographical location of each retail space, the conditions of the surrounding commercial environment within a radius of 250 meters have been established. For each retail space, the number and degree of retail occupation of the surrounding area have been determined, as well as the composition and commercial specialization of activities within the analysis radius.

Thus, a retail space located in an environment with more than 40 open retail spaces, an occupation rate of retail spaces above 80%, and a presence of convenience stores above 30%, has been rated with an A, a distinction for top-quality locations. Conversely, a retail space in an environment with more than 40 retail spaces and severe retail desertification (occupation <70%) has been classified with a D. This classification process has been applied successively to each and every one of the 250,000 retail spaces.

Scatter plot of hexagons based on retail occupancy (Retail Occupancy Index – ROI) and destination retail presence (Destination Retail Index – DRI).

To simplify the calculations and also the reading of the results, the retail spaces have been aggregated into hexagons of 500 meters in diameter, approximately 0.2 km², and the geographic environment defined by the hexagon has been rated, assigning the qualification to each of the retail spaces located within it.

In total, more than 2,200 hexagons have been rated in the 12 cities, representing a geographical area of almost 500 km².

Chart showing the distribution of hexagons according to the commercial quality of the geographic environment.

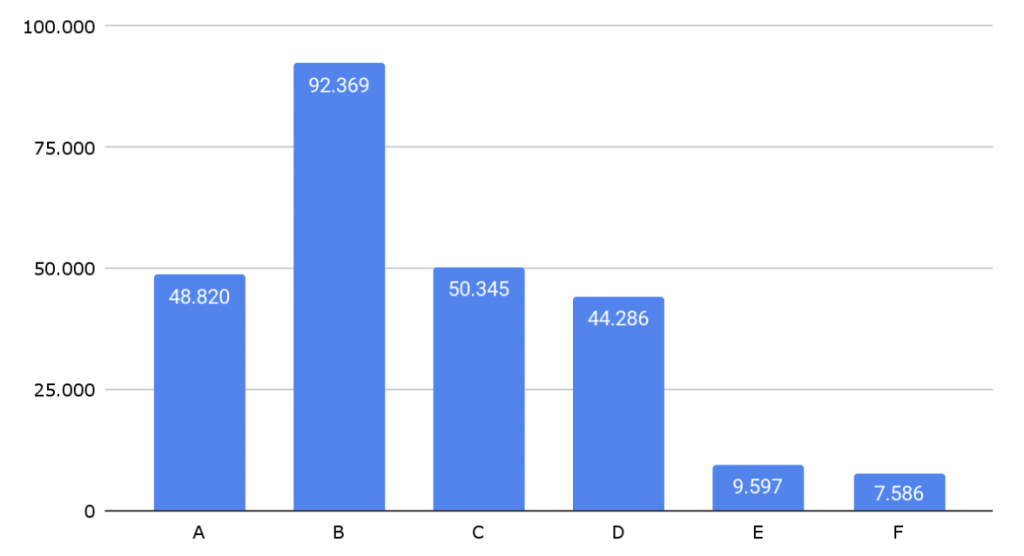

Graph showing the distribution of retail spaces according to the commercial quality of their geographic environment.

Finally, the rating of the studied retail spaces park is as follows:

20% maximum quality location

35% good quality location

20% regular quality location

25% unfavorable or poor quality location

More than half of the retail spaces are in a good or excellent location, a fifth are in a regular location, and a quarter are in an unfavorable or poor location.

Results by city. The distribution is very even, there is competition.

In the 12 studied cities, there are at least two hexagons with the maximum category. Or in other words, there is a commercial area of almost half a square kilometer and at least a thousand retail spaces in an excellent commercial environment.

In Palma, the best-rated hexagon out of the 2,200 is found. Sevilla has the second best-rated. Bilbao, Murcia, Zaragoza, and Málaga have hexagons in the top 20 best-rated. This is a clear indication that the commercial playing field is very evenly distributed, and therefore, there is competition.

While some cities have more hexagons of lower commercial quality (D, E, F), this is more due to urban planning and topography than to any socio-economic factors. Therefore, excessive vacancy of retail spaces is not a problem that can be generalized to all cities, nor within each specific city, to the entire city.

The area of the historic center of Palma has a high presence of non-daily establishments: personal equipment, home equipment, culture, and leisure.

It contains three hexagons of maximum rating, which are part of the top 20, one of which (Hex 19794) occupies the first position.

Empty Retail Spaces and Housing: Two Birds with One Stone?

In recent years, there’s been much discussion about the abundance of empty retail spaces and how transforming these persistent vacancies into housing could significantly increase the housing stock while reducing the presence of empty retail spaces in our cities. Two birds with one stone.

One of the outcomes of this report was to evaluate with sufficient data and indicators the validity of this thesis or if, on the contrary, it was a myth.

Of the more than 250,000 retail spaces analyzed in the 12 cities, about 50,000 have been identified as closed or vacant. Of these, approximately 20,000 have been rated with a poor or unfavorable commercial environment (D, E, F) and, therefore, as difficult-to-occupy or persistently vacant retail spaces. And, of these persistently vacant retail spaces, we assumed that less than 50% could obtain a habitation certificate to become housing. Although we believe that we have been very generous and that the percentage of retail spaces suitable for residential use would actually be much lower than 50%, we preferred to calculate with an optimistic hypothesis. After all, if with the most optimistic hypothesis the number of retail spaces was not significant, we would have an even more solid result.

Therefore, finally, we would have about 10,000 persistently vacant retail spaces candidates for transformation into housing. These candidate retail spaces would represent 4% of the 250,000 retail spaces park and 0.11% of the total park of 5 million homes in the 12 studied cities. Specifically, in Barcelona, all persistently vacant retail spaces would represent 8% of the real estate offer of a single year, and less than 1% of the offer of a decade.

The conclusion that can be drawn from these data is twofold. On one hand, persistently vacant retail spaces are not a systemic problem in the 12 studied cities. The scenario varies quite a bit from city to city, and the presence of persistent vacancies has a lot to do with the urban planning and topography of each geographic area. On the other hand, the impact that all persistently vacant retail spaces, converted into housing, would have on the housing real estate market, would be limited (less than 1%) and temporary (until the persistent vacancies were exhausted).

Therefore, the persistently vacant retail spaces of all 12 cities are neither a systemic problem nor the solution to the housing shortage issue.

In Barcelona, there is a park of 76,500 retail spaces, of which 14,000 are closed or vacant, and of these, only 2,200 are persistently vacant.