Retail turnover rate, the change of economic activities to a particular urban area, varies based on a number of factors: the commercial attractiveness of the area, the real estate pressure arising from the expectations of the performance of an economic activity in the area, the sort of activity and degree of specialization of the businesses located in the area, etc.

Although retail turnover is a natural phenomenon and is a reflection of commercial vitality, very high turnover rates may result in the loss of a reference context and, as a consequence, the loss of retail identity in the affected area.

That said, this is a comparative report that does not go into assessing whether the rotations observed in Barcelona, even the highest ones, are “too much” or are detrimental to the business fabric.

To make this report, the Eixos.cat economic activities database has been used. This data base has been build from visiting, classifying and geolocating every single retail space in Barcelona on a regular basis once a year since 2012. The period established for the calculation of turnover rates is 2012-2018.

From here, the activity history of each of the retail spaces in Barcelona has been established during this period, and the year-on-year rotation by retail space, by street and by district has been calculated in order to be able to compare and detect patterns of behavior that explain the most determining factors in the variation of the retail turnover, established by the annual Retail Turnover Rate (RTR).

In order to contextualize and understand the behavior of this index, we have compared it to the retail health indicators scenario on every district and neighborhood.

Eixos.cat sets the stage for the commercial health of an area based on three combined indicators:

Retail Occupancy Index (ROI) -> % of occupied retail spaces.

Destination Retail Index (DRI) -> % of destination retail stores (personal items, household goods and culture & leasure)

Retail Density Index (RDI) -> Number of retail stores per 100 inhabitants.

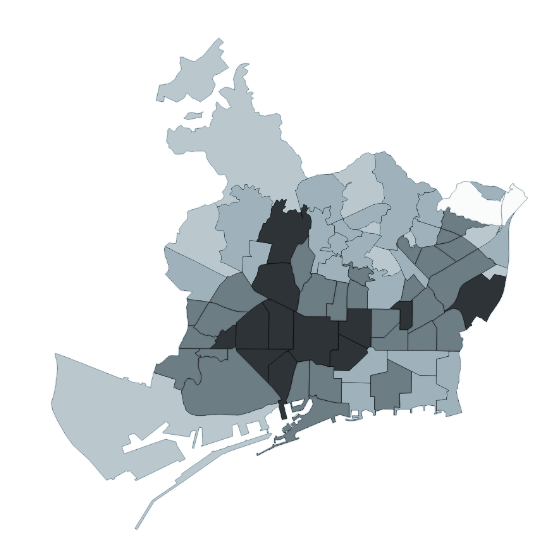

ANNUAL RETAIL TURNOVER RATE (RTR)

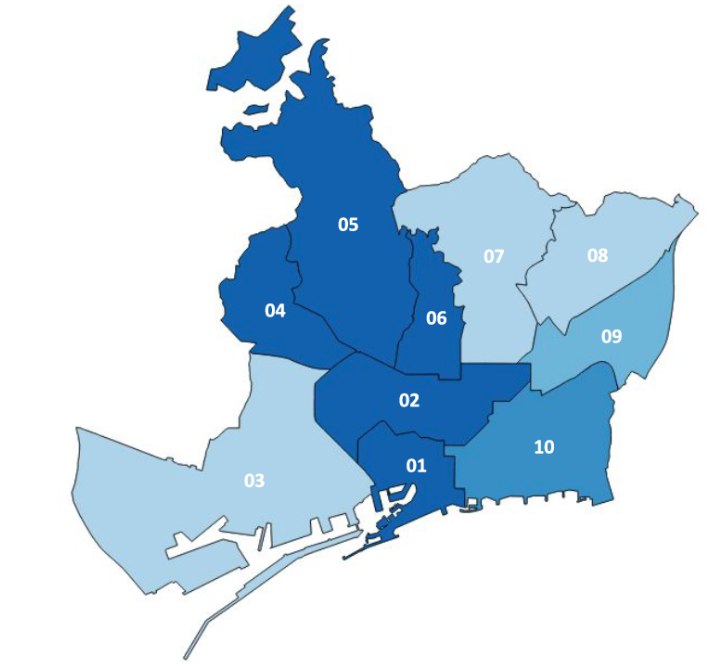

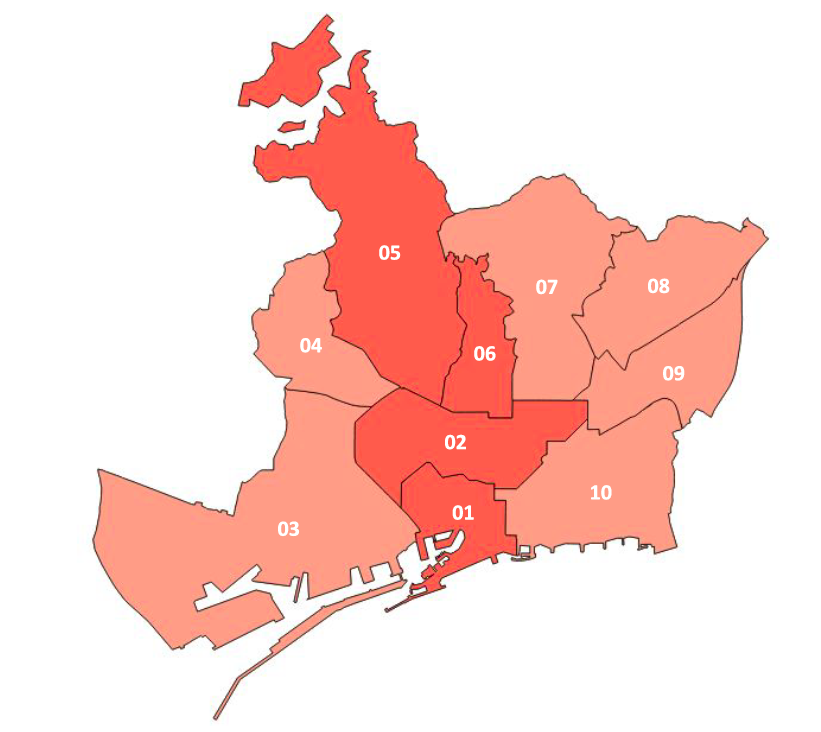

By district, we see the highest average rotation in Sarrià – Sant Gervasi, Eixample, Ciutat Vella, Sants – Montjuïc and Sant Andreu. Sant Antoni (RTR 25.94), in the Eixample district, is the district with the highest turnover.

Some of the main shopping areas in Barcelona with the highest turnover are Carrer Mandri, in the district of Sarrià – Sant Gervasi, with almost 36.11% year-on-year rotation, and Portal de l’Àngel in Ciutat Vella with the least rotation, just over 19.01% per annum.

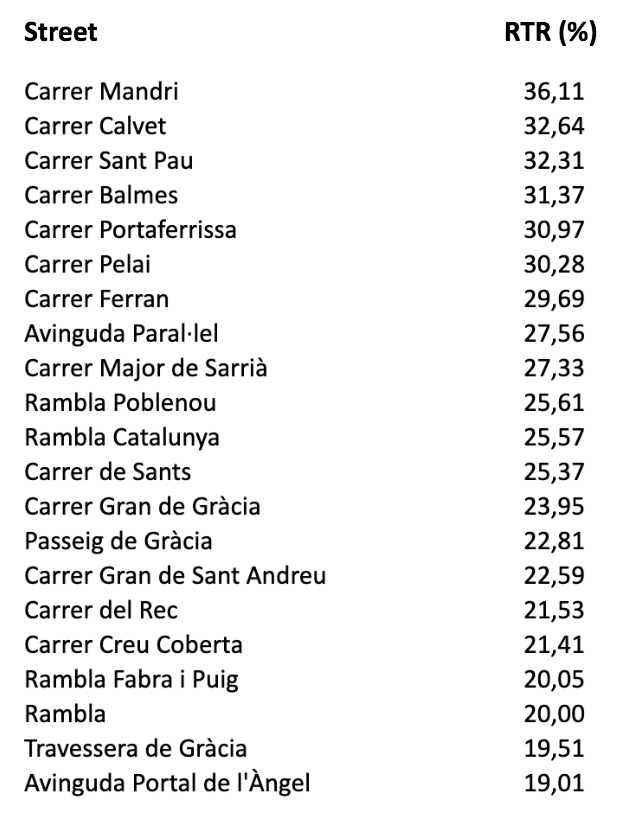

RETAIL HEALTH

Retail Occupancy Index (ROI)

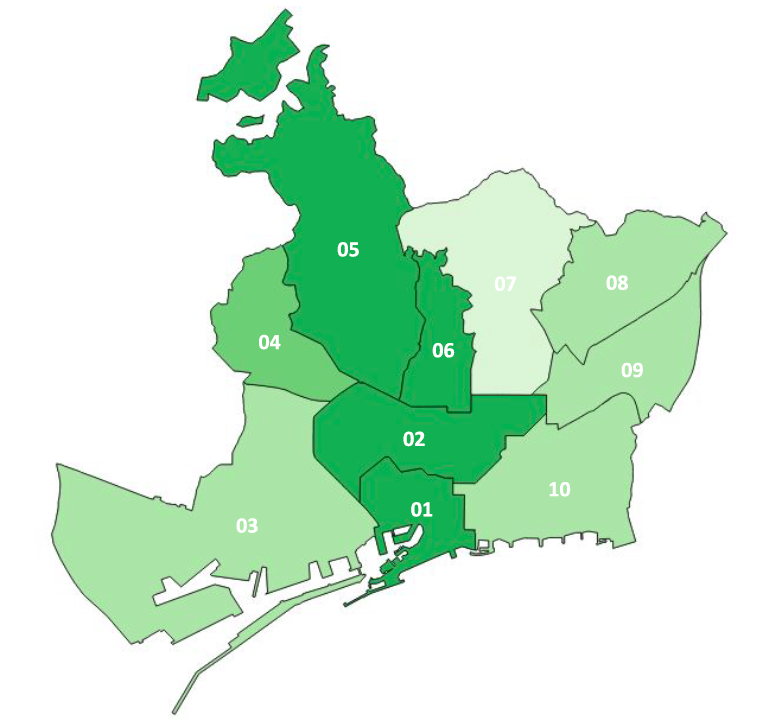

We observe the highest retail occupancy in the districts of Ciutat Vella, Eixample, Gràcia, Sarrià – Sant Gervasi and Les Corts.

RETAIL DESTINATION INDEX (RDI)

We observe the highest destination retail index values in the districts of Ciutat Vella, Eixample, Gràcia and Sarrià – Sant Gervasi.

Retail Density Index (RDI)

We observe the highest retail density index values in the districts of Ciutat Vella, Eixample, Gràcia and Sarrià – Sant Gervasi.

CONCLUSIONS

The districts of Ciutat Vella, Eixample, Gràcia and Sarrià – Sant Gervasi, which have the best combination of retail health indicators, have a higher RTR.

The Bon Pastor neighborhood also has good indicators of commercial health, although within the Sant Andreu district it is surrounded by neighborhoods with a much lower commercial vitality, which makes it difficult to relate at district level. At the district level, however, El Bon Pastor has one of the highest turnover rates in Barcelona.

As a general conclusion we can say that the areas with the best health scenario are also those with the highest turnover.

Therefore, at the district and district level, we can establish a fairly direct correlation between the commercial success of an area and its turnover in commercial premises. Thus, the commercial success of an area would attract new businesses, which would like to participate in this success, and generate more real estate pressure which would accelerate the turnover of activities.

At street level, however, we see that this correlation between success and turnover rate needs to be modulated, given that Portal de l’Àngel, the most commercially attractive street in Barcelona (and Catalonia), has an IRC 19.01, closer at low turnover rates (RTR around 15.08) than at high turnover rates (RTR around 30). This should be attributed to a combination of factors: the high street specialization (87% of individual equipment stores) and the high presence of top brands, which can take on the price increase of premises. , which on the streets like this becomes prohibitive for independent retailers and small brands, limiting the funnel of customers who can access them, and making them more resilient to turnover.

We can say, then, that the exclusivity factor of a commercial area, with high specialization and access to premises, restricted by price or other factors, reduces the access to new activities and limits their turnover rate.

Although it has not been the subject of this report, we should mention another case of reduced turnover rate by concentration, specialization and limitation of access: the municipal markets. Having tracked the municipal markets of Catalan cities, it is very common to see shops closing / changing their business as a result of the shopkeeper’s retirement. That is, they can remain in operation for decades.

Another figure of public-private management, originating in the Anglo-Saxon world and with some parallels with the municipal markets but for the retail highstreet, is the Business Improvement District (BID) or what in Catalonia is known as the Economic Promotion Urban Area (EPUA).

The results of this report suggest that BID / EPUA would be a good tool for improving retail health scenarios and, at the same time, mantain retail turnover rate under control.